For property becoming qualified to receive an excellent USDA mortgage, it should meet with the very first qualifications criteria established of the USDA, that cover rural town designation, occupancy, plus the health of the property.

Thankfully that every of the country is actually just what USDA takes into account a qualified rural area. However it is very important to possible buyers to check on an effective home’s qualification standing prior to getting too much towards the procedure.

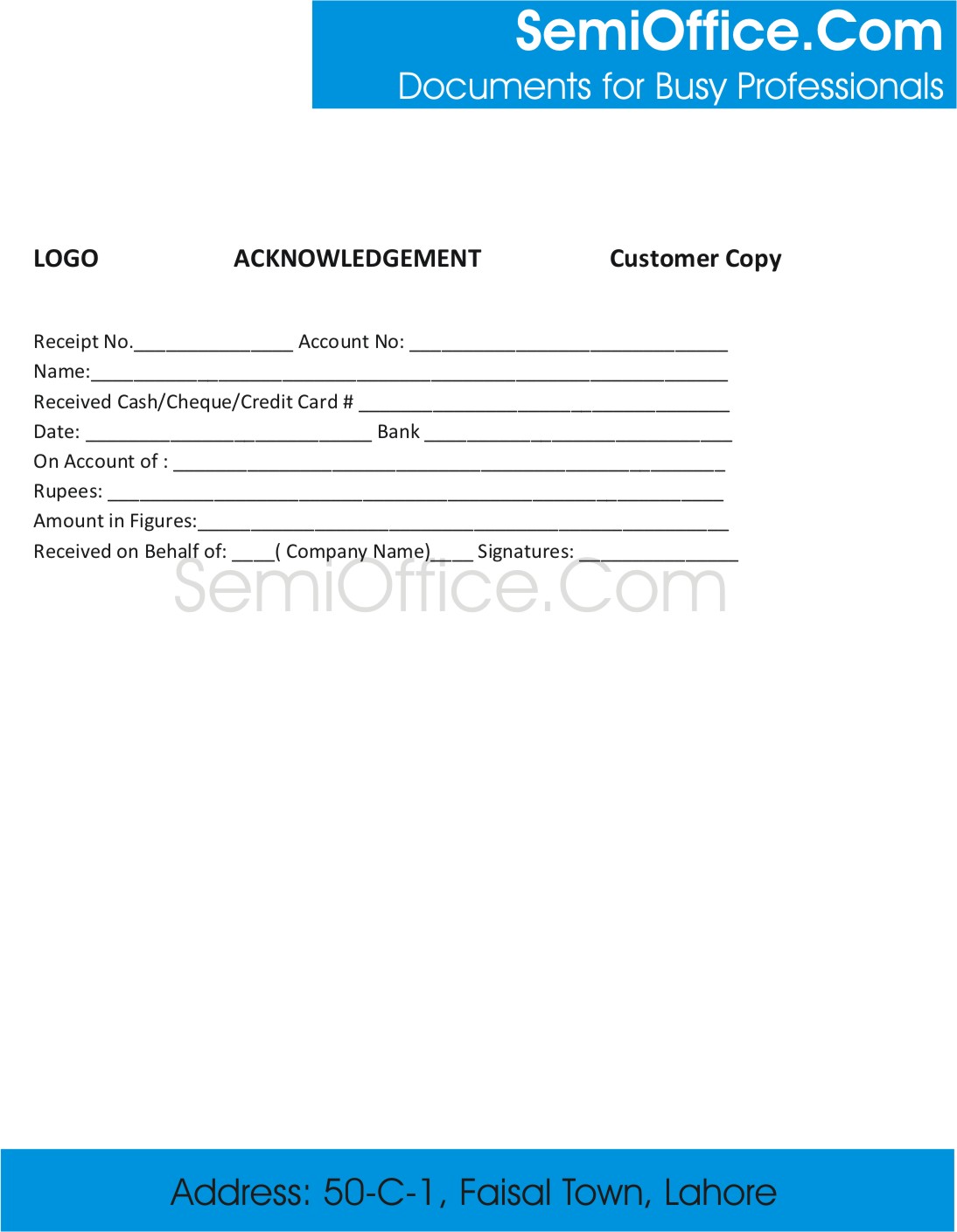

USDA Qualification Chart

You need which entertaining chart to aid know if a good domestic already match new USDA’s assets qualifications criteria. Components for the red are not currently eligible for a good USDA-backed loan.

Property eligibility parts changes per year consequently they are predicated on society size or any other items. This chart is actually a good book, however the USDA makes a final commitment on property qualification after you will find a whole application for the loan.

Should your prospective house drops near or perhaps in a place one to will not appear to meet up with the rural designation, a good USDA-accepted lender can verify new address from USDA’s on the web webpage.

To confirm your own address to possess a good USDA mortgage, it’s always best to consult with a good USDA-approved lender. An effective USDA-approved bank can also be make sure all of the characteristics you are searching for and you may be sure to you should never waste work-time with the services that may maybe not meet the requirements.

What is an excellent “Rural” Town?

Having a property meet up with the newest USDA’s outlying definition, it ought to be from inside the a place which is discover outside an effective city otherwise town and never with the a city

- A populace that does not go beyond 10,100, or

- A society that will not meet or exceed 20,000; isnt based in an urban analytical city (MSA); and has a serious decreased home loan borrowing to have reduced- to reasonable-income parents, or

- Any area that was shortly after classified because “rural” otherwise an effective small loans in Leadville CO “outlying town” and you can destroyed their designation as a result of the 1990, 2000 otherwise 2010 Census can still meet the requirements in the event your area’s populace will not go beyond 35,000; the bedroom is outlying when you look at the reputation; additionally the area features a critical not enough financial borrowing from the bank getting low- and you will reasonable-income household.

These guidelines try reasonable in the same way a large number of small towns and suburbs from towns slide in conditions.

Lowest USDA Assets Conditions

Brand new USDA desires make sure the household you choose match certain assets requirements to safeguard new borrower’s attract and you will well-getting.

First of all, your house need to act as most of your residence. Thank goodness, many assets products meet the requirements to have USDA money apart from to order good pre-current house, such as:

- Brand new framework

- Are built or modular house

- Apartments and townhouses

- Short conversion and you can foreclosed home

USDA money can’t be used in funding functions, definition farms, rental or trips land, or other earnings-creating functions are not qualified. However, property that have acreage, barns, silos and so on that are no longer when you look at the industrial fool around with may still qualify.

Particular USDA House Conditions

New USDA necessitates the home to become structurally voice, functionally sufficient along with a fix. To ensure your house is during a good resolve, a qualified appraiser have a tendency to check and you will certify the home match latest minimum assets conditions established inside the HUD’s Solitary Friends Casing Plan Guide.

- Access to the property: The property is going to be obtainable out of a paved otherwise all of the-weather path surface.

- Structurally sound: The origin and you can home should be structurally voice on life of one’s home loan.

USDA financing has actually yet another appraisal process than other loan sizes in the same way your appraiser is actually making sure the house or property matches all of the requirements put because of the USDA as well as determining the brand new fair market price of the property. Understand that appraisals commonly such as-depth just like the a house check.

Most other USDA Qualification Standards

On a single amount of benefits since USDA possessions criteria certainly are the USDA’s credit and you will earnings criteria. Due to the fact USDA does not enforce a credit score minimal, the application form really does enact income limits, adjusted getting family size, to make certain the funds increase the reasonable- so you can center-money families the system was designed to have.

USDA money limitations amount toward most of the mature members of the family, but differ from the location and you may family proportions. The base income constraints is actually:

Due to the fact UDSA assets eligibility chart shows an over-all idea of licensed towns, it is best to request a good USDA financial to ensure the location is really qualified. For the reason that change to what the latest USDA considers qualified since rules and communities changes.

Leave a Reply